A look back at 10 years of domain name buyouts in the nTLDs

Solidnames has studied almost 500 domain name takeovers in new Internet extensions (“nTLDs”) over the last ten years.

Ten years ago, the first new Internet extensions gradually began to open up to everyone. On the eve of a second “New gTLD” program in 2026, we wanted to take a look at the second market for domain names registered in these new extensions.

In this study (*), we will see:

- Which are the most expensive nTLD domain names?

- In which extensions are there the most buybacks?

- What types of domain names are the most popular to buy?

- What are the best years for domain name buyouts?

- How are purchased domain names used?

To do this, we used the annual list of public takeovers published by DNJournal.com. Each year, this site draws up a top 100 list of .COM transactions, another top 100 list for country-code extensions and a final list for other extensions, including nTLDs. The amount of buyouts is therefore necessarily overestimated in relation to a general average, as these are the most expensive sales.

What are the biggest domain name takeovers among the “New gTLDs”?

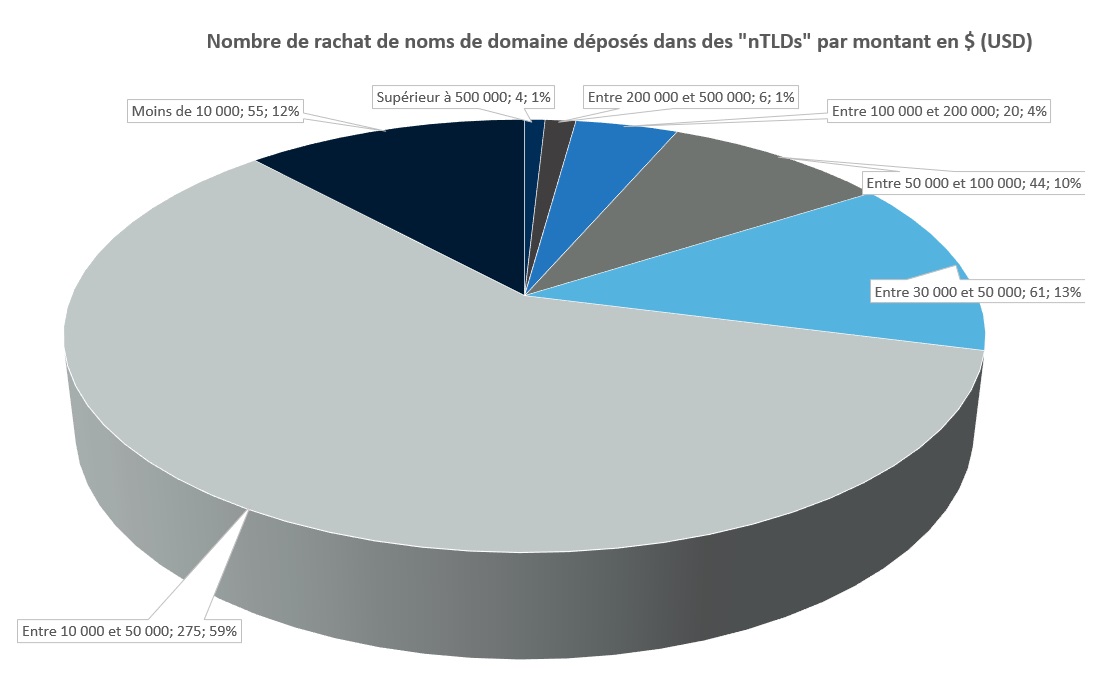

The 465 redemptions have generated over US$16.3 million in 10 years.

Three transactions exceed $500,000: Online.casino, Vacation.rentals and Home.loans. Six buyouts are between $200,000 and $500,000 (e.g. shop.app at $200,000).

20 sales between $100,000 and $200,000. 44 sales were between $50,000 and $100,000; 61 between $30,000 and $50,000.

The majority of buybacks (59%) took place between $10,000 and $30,000, with 275 sales.

Finally, 55 transactions were carried out for less than $10,000. The lowest amount on the lists studied was $7,500.

Prices for buying back domain names registered in nTLDs

nTLDs with the highest number of domain name buyouts

Our 2024 ranking of million-dollar extensions featured a record number of domain names registered in “New gTLDs”. There are now over 40 million domain names registered in the new Internet extensions.

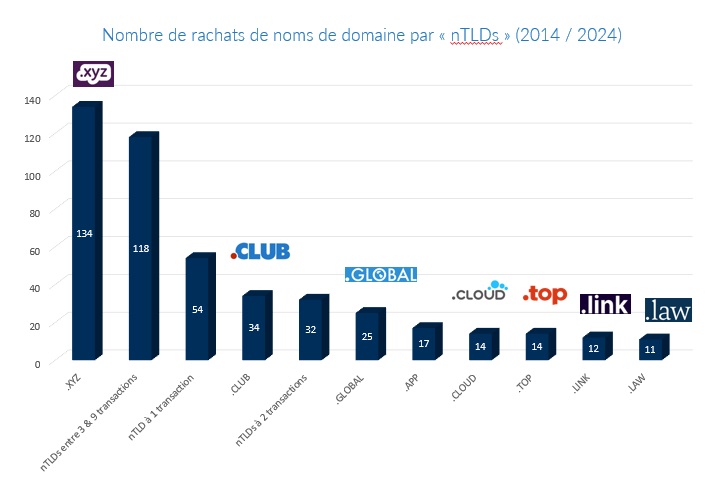

The nTLD with the most domain names registered is .XYZ (4.2 million domain names, 10% market share).

This being the case, it’s only logical that .XYZ should be the Internet extension with the most public sales. The “nTLD” accounted for 134 buyouts, or 29% of the transactions studied.

The other nTLDs are much further behind, with 34 sales for .CLUB and 25 for .GLOBAL. Some of these “New gTLDs” even organized auctions themselves to sell their “premium” domain names. Many of these transactions may appear misleading, as we’ll see later in the section on usage associated with these domain name buyouts.

25% of operations were carried out in new Internet extensions with between 3 and 9 sales (e.g. ..CHAT, .LIFE, .ONLINE, .SHOP, .TECH…).

Several “nTLDs”, such as .DIGITAL, .PHOTO and .STORE, had only two sales.

New gTLDs with the most domain name buyouts

It’s worth remembering that among the new Internet extensions, there are several sub-categories.

One is dedicated to .MARQUES. There were no sales for Brand TLDs, which are by their very nature reserved only for companies that have created their own .MARQUES.

So there are also the generic extensions we’re looking at, as well as “geoTLDs”. Some geoTLDs associated with a specific territory, such as .BERLIN, .NYC (New York) or .MIAMI, as well as (cocorico) .PARIS, have achieved one-off sales. The domain name <eth.paris> changed hands for $50,000.

Short, meaningful domain names mainly bought in new Internet extensions

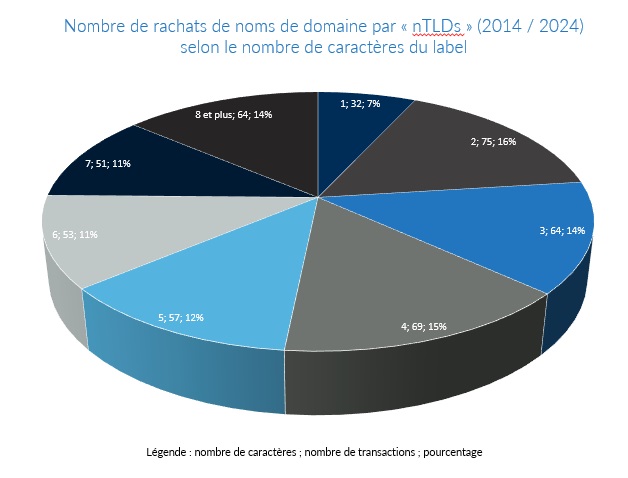

Domaining experts often point out that a short, memorable domain name is more valuable than a lambda name.

This “rule” of domain name investors seems to be borne out by our study of the largest domain name buyouts among “nTLDs” over the last 10 years.

Our analysis focuses on the label, i.e. the character string before the dot delimiting the Internet extension.

Over 51% of sales are devoted to labels with a maximum of four characters. Among this majority of very short names, there are even 32 one-character names and 75 two-character names.

Number of characters of domain names bought in nTLDs

Some of these short domain names are made up entirely of numbers. There are 27 of them (e.g. <0.vip>), or 7%.

Certain terms appear in several transactions in “nTLDs”. The word ETH (the acronym for Ethereum) appears seven times (e.g. .BLACK, .CEO, .WEBSITE…).

The following terms appeared in three transactions: Bitcoin, Creator, Eclipse, Energy, G, Go, M, My, Pay, Smart. Many other words appear at least twice in different nTLDs, such as Shop, Simple, Wallet, Web or World.

Domain name buybacks among nTLDs over the past 10 years

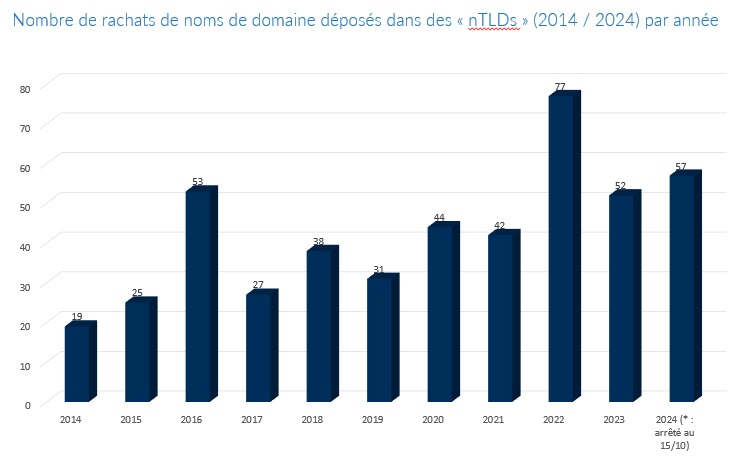

Over the past 10 years, the number of transactions among new Internet extensions has been fairly uneven.

The first two years were logically weak. Thereafter, 2016 saw a slight peak before three more years with fewer than forty redemptions.

From 2020 onwards, the threshold of forty annual sales was systematically exceeded.

The record number of transactions occurred in 2022, with 77 sales. 2023 was the second-best year, with 52 transactions. Finally, 2024 will be a very good year. It has already surpassed 2023, and the year is not yet over.

Number of domain name buybacks in new Internet extensions per year

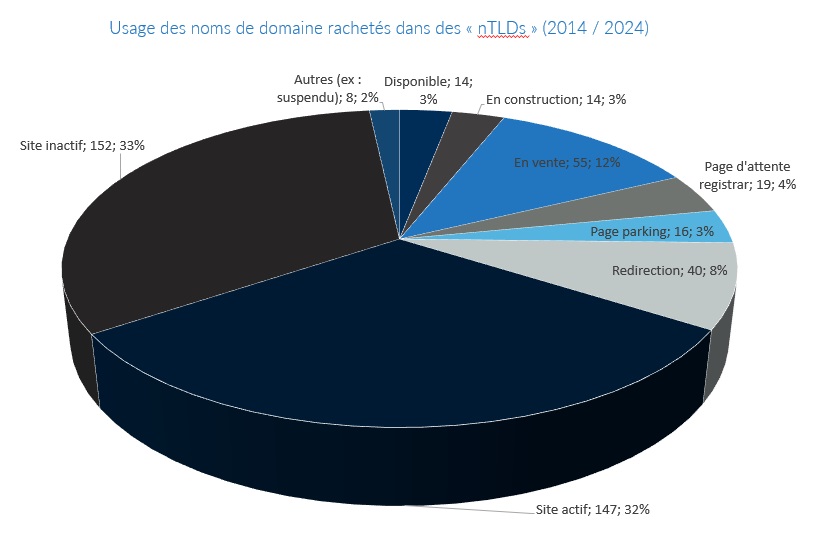

What happens to domain names bought out under the new Internet extensions?

When a buyer spends several thousand or even tens of thousands of dollars to acquire a domain name, it’s expected that he’ll use it.

Almost 32% of domain names acquired over the last ten years have a website.

Numerous sites active around NFTs

Among these active sites, the blockchain, NFT and Web 3 sectors are strongly represented. In fact, 22% of active sites concern this sector (e.g. affinity.xyz, bc.xyz, bitcoin.casino, blockchain.ventures, coin.news…).

In general, finance is also present, and not just in cryptocurrencies. The world of video games is also well represented.

Artificial intelligence also has active sites among the “New gTLDs”, such as create.xyz ($95,868) or data.world ($10,000).

In the rest of the active sites, there’s a little bit of everything, like :

- c.live ($28,500): a live-streaming application.

- vacation.rentals ($500,300): a vacation rental site.

- casino.online ($201,250) and the reverse version online.casino ($510,000) for cash games.

- blade.shop ($10,000) for beer machines.

- simple.life ($20,000): a weight-loss application.

- disability.law ($12,500) for specialized lawyers.

- hookup.app ($45,000) or singles.club ($8,100) for dating sites.

- mv.health($9,000): sex toy sales.

- aura.life ($8,500) for funeral arrangements.

- celebration.church ($18,000) operated by a pastor.

When it comes to e-mail associated with acquired domain names, 76% of all domain names surveyed have no e-mail configured. E-mail usage appears to be even lower than web usage.

Domain names bought in “nTLDs” to redirect to a site registered in a generic extension

According to our audit, 8% of domain names surveyed redirect to a site registered in a classic extension, notably .COM.

So Ledger, the French start-up that designs and markets physical crypto-currency wallets for individuals and businesses, has bought wallet.live for $7,500. It redirects the wallet to its ledger.com website.

Coffee.coffee ($14,500) redirects to ecoffee.com, a site selling coffee machines.

Another example is BroadwayTickets.nyc ($25,000), whose redirect takes us to broadway.org.

These redirected domain names sometimes include the purchase of a domain name in an nTLD included in the .COM address.

This is particularly the case for :

- English.club ($17,500) to englishclub.com, a site for learning English.

- Joy.club ($10,000) to joyclub.com, a dating site.

- Lk.global ($12,000) to lkglobal.com, a law firm specializing in intellectual property.

A majority of domain names bought… unused

Skeptical observers of the new Internet extensions are in for a treat.

In fact, almost a third of the domain names purchased over the last ten years lead nowhere. In other words, the site cannot be found (e.g. bull.xyz at $199,888) or ends up on a blank page.

Some inactive names are actually owned by major brands. Apple, for example, bought Apple.global for $10,000… only to do nothing with it except renew it with its registrar MarkMonitor for almost 10 years.

Cruise line Viking River Cruises bought the domain names Baltic.cruises ($25,000) and Ocean.cruises ($9,900) in 2014. Since then, they have been managed by their registrar, CSC Corporate Domains, with a clean slate.

Use of bought-out domain names among new Internet extensions

Other unused domain names also promote their registrar (4%).

400,000 to buy the Betting.online domain name and promote its Safenames registrar – that’s not cheap.

A dozen sites are currently under construction. Let’s hope that their future use will be compliant and won’t lead to them being suspended like Hosting-Cloud.blog, which was bought out for $30,000 all the same.

The myth of spectacular domain name reselling

While many domain names (4%) display a parking page (page with commercial advertising links), many (12%) are clearly listed for resale.

Just imagine! The buyer of The.club domain name for $19,000 in 2015, would have resold it for $300,000 in 2018!

This beautiful story (to be verified) is the exception that puts the rule to the test. Indeed, the rule is that many people have invested substantial sums in the hope of lottery-worthy resales. In the meantime, they wait for the imaginary wealthy buyer, not to say the sucker.

The buyer of A.company ($22,000) and E.company ($25,105) is offering each of these domain names for a cool $1,230,000.

Free.bet ($20,500) and Play.xyz ($17,770) are also hoping to make a big splash, offering them for sale at a fixed price of $248,888 and $300,000 respectively.

They almost make Cannabis.city (bought out at $12,000 and now offered at $50,000) or We.link ($11,000 for $60,000) look like investors with modest ambitions.

For domain name specialist David Chelly, ” There are bogus sales, people who dream. The far-fetched resale prices will never be reached.

DNJournal’s sample concerns only the largest transactions. There are many more sales than that which are not published. They come in all shapes and sizes, often at more reasonable prices. “.

Names bought for thousands of dollars now free

Of the surveyed names bought back, 3% are now free… For example, ADO.tech bought back for $10,000 in 2018 has fallen back into the public domain. It is now available for purchase, with a premium price by the way. Ditto for AirConditioning.online ($19,990), Meet.club ($12,500) or Wedding.global ($8,100).

In other special cases, redeemed domain names have been abandoned, then redeposited, before being listed for sale again.

This is notably the case for Dubai.app, bought back for $10,000 in 2019, re-filed in 2024 following its expiration, and now offered for sale for $99,888. The same goes for Sherpa.group. It was bought back for $14,280 in 2017 and redeposited in 2020 following its abandonment. It is now offered for sale at $20,000.

While new buyers hope to resell at a higher price than the initial purchase, other owners are less greedy.

For example, CBD.world, purchased for $20,000 in 2019 and re-registered in 2024 following its non-renewal, is listed for sale at $5,300. This is also the case for Hey.money sold for $8,888 in 2019. It was re-filed in 2023 following its deletion. It is now available for sale at a fixed price of $6,999.

The reality of the secondary market for domain names registered in nTLDs

The high proportion of unused names must be weighed against the long 10-year period studied. In the space of a decade, many things can change and projects can be abandoned.

Nevertheless, suspicion about the reality of certain transactions is understandable. What’s more, the financial flows generated during these sales provide a source of income for those who receive them.

Despite this dark side, there are many active sites among the new Internet extensions. Statistically speaking, nTLDs have never done so well in the last 10 years. The arrival of a new round of “New gTLDs” in 2026 will further increase the number of opportunities for domain name registrations, and perhaps even takeovers!

In conclusion, there is a second market for domain names registered in nTLDs. It may be tainted by undoubtedly spurious transactions, but its reality is not in question. The second market for domain names registered in “nTLDs” represents 15% of the largest sales recorded by DNJournal.com over the last ten years.

(*) Study conducted on the largest annual public transactions revealed by DNJournal.com between 01/01/2014 and 15/10/2024.

In particular, DNJournal.com compiled buyouts from: Afilias, Afternic, Dan, DNGear, Dyandot, .Global Registry, GoDaddy, Jiangsu Bangning, NameJet, Radix, Rightside, Sedo, Uniregistry, West.cn…

Thedomain name usage audit was carried out by Solidnames on October 27, 2024.

Solidnames did not study the type of buyer of the domain names; most of the whois data linked to the holders is protected via confidential whois and does not allow a relevant analysis.